At the end of the 2008 global financial crisis, as the US banking industry was left battered and bruised, an alternative financing concept emerged – the Peer-to-Peer (P2P) Lending. Peer-to-Peer (P2P) Lending was the provision of funds to individuals or legal entities through specialised online loan sites (P2P platforms) without intermediaries such as banks or traditional financial institutions.

The idea of P2P Lending was conceived during the crisis when businesses’ finances dried up, and traditional loans were difficult to obtain, forcing them to source for other financing methods.

Instead of obtaining credit from the banks, borrowers can get their loans from lenders through an online platform. Although the fundamentals of P2P Lending, also known as debt crowdfunding, crowd lending, or marketplace lending is similar to crowdfunding, the differences lie in that the P2P loans are to be repaid with interest, a feature similar to loans from traditional banks.

Asides from providing credit, P2P Lending also doubles up as an investment platform in which the lenders that provide the loans are also investors to the borrowers’ business. This not helps to offer more financing options to businesses, but it allows lenders to expand their portfolio.

Pros and cons

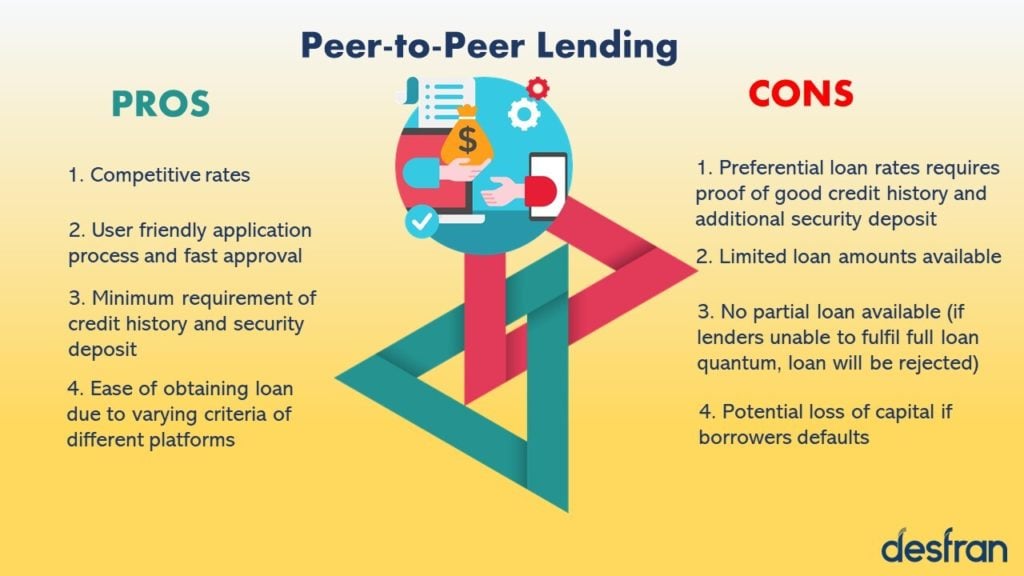

Although P2P Lending’s rising popularity may seem appealing for many, it is important to understand both the benefits and risks of P2P Lending to avoid potential pitfalls.

Comprising of a combination of collective financing and insider funding, P2P Lending is able to offer both secured and unsecured loans due to its less rigorous vetting requirements as compared to a bank. P2P Lending also omits the need for existing social relationships between the borrowers and lenders for a transaction to happen and these transactions can be decided based on the credit information or assets backing of the borrower. Generally, platforms in P2P Lending operate at lower costs compared to conventional credit institutions due to its online nature and this enables them to offer more attractive conditions for both borrowers and lenders by transferring the lower cost to all parties involved. The faster turnover time of the P2P Lending compared with the often tedious and time-consuming loan application process from a traditional bank allows businesses to reposition quickly to seize opportunities amid current coronavirus pandemic.

The following figure highlights the advantages and disadvantages of P2P Lending and focuses an important aspect of Peer-to-Peer Lending, which is the adoption of human-centric approach that accelerate the loan process.

From the onset of the coronavirus outbreak, P2P lending platforms have stepped up to bridge the gap left by the banks, providing SMEs with loans during this unprecedented period. According to the United States Federal Reserve, one-third of the US small businesses are only able to apply for loans from P2P lenders as they lack an existing lending relationship with primary financial institutions and hence are unable to access to a loan facility which had led to the mainstream attention on P2P Lending and its efficiency as compared to conventional banks.

Despite the ease of acquiring a loan on the P2P Lending platform, the perils of these platforms stem from its lack of transparency and governance. One of the broader issue that comes with P2P lending platforms is the misleading advertisements of high return rates promised are only under specific financial conditions, and stipulated returns rate are merely targets and not guaranteed. Due to the lack of governance and tracking, lenders will face difficulties in recovering their loans should there be a delay of repayment and may potentially lose most, if not all of their initial capital should the borrower defaults.

Therefore, it is important to research and compare different platforms on several criteria before committing in a Peer-to-Peer lending platform as a borrower or a lender. Some of these criteria include the credibility and reputation of the platform, its default rates, the loan terms and fees, and its regulation and governing frameworks.

What’s next for P2P Lending?

Advancements in FinTech have opened up new ways for business financing. Other than the straightforward traditional P2P Lending, other financing models have also emerged to involve loan originators, banks, and balance sheets. Notably, the coronavirus pandemic has shed some light on peer-to-peer lending platforms due to its collaboration with the banks to provide loans to the underserved markets. By adopting FinTech as a data processing and analytical tool, P2P lending platforms were able to simplify and shorten the loan application process, from offering user-friendly online application and to processing massive amounts of loan applications within a short span of time. This resulted in an increase in the number of customers securing loans during this crunch time. With increasing partnerships with banks and other financial institutions to cater to the underserved customers, the future growth of Peer-to-Peer Lending platform has infinite possibilities in extending their reach and diversifying the products and services.

The Bottom Line

Revolutionising the lending landscape, Peer-to-Peer Lending platforms have grown to be one of the key enablers for financial inclusion. The growing collaborations between P2P platforms and conventional financial institutions are set to be the next game-changer as banks with its wide customer base and risk management capabilities will further provide peer-to-peer lending platforms with a more reliable credit assurance. By weighing the advantages and disadvantages of P2P Lending, it is vital for businesses considering loans to delve into a more in-depth research for a suitable platform. As a corporate advisory solutions provider with an in-depth knowledge on the industry, Desfran can help position your business finances and seize opportunities for a post-pandemic recovery.

Contact Desfran today.

References

The Creation of P2P Lending, Techcrunch.com

Peer-to-peer Lending, Xero.com.sg

The growing popularity of peer-to-peer Lending, Switzer.com.au

Peer-to-Peer (P2P) Lending Market Worth $44+ Billion by 2024 – Trends & Developments, Company Profiles, Market Outlook, Strategic Recommendations, Globenewswire.com

Pandemic hands fintech lenders a chance to prove their worth, FinancialTimes.com

Online lenders are stepping up to fill the gap left by banks during the pandemic, TheGuardian.com

Changes and Concerns in the Peer-to-peer (P2P) lending market, Deloitte.com

Your guide to P2P Lending in Singapore, Finder.com.sg

Why P2P Lending models are changing, Finextra.com