The spreading of the coronavirus pandemic across the world has driven the global economy into a state of chaos, with market stocks and oil prices dropping to the new low as well as businesses and SMEs across various sectors heavily affected. However, as the saying goes,” crisis brings about opportunities”, the coronavirus outbreak seems to have also propelled the growth of certain sectors, which in this case, is the rise of virtual banking.

Confused by many financial amateurs, virtual banking is often mistaken as internet or e-banking. Virtual banking and e-banking are two different concepts. The former is a bank that primarily provides retail banking services and products through the use of the internet or other forms of the electronic channels without any setups of a physical branch. Whereas the latter refer to online financial banking services offered by banks with physical branches.

The emergence of virtual banking has spiced up the banking landscape. Despite being at a nascent stage of development, the virtual banks have already posed as a potential threat to the traditional banks, going head-to-head with each other to survive in the competitive financial sectors.

The Rise of Virtual Banking

Even before the threat of the global pandemic, the seed of virtual banking has started to sprout, as a result of the technological race in recent centuries. From the evolution of broadband internet infrastructure to 5G and free internet connection via satellite, the availability of internet has transformed the way people work, giving rise to virtual banking. However, besides technological advancement, there are many other factors that propel the emergence of virtual banking.

Emerging E-commerce and FinTech Market

In today’s digital landscape, coupled with the on-going global pandemic, consumer behaviour has changed drastically with a shift towards the preference of digital solutions. From the leisure activities to the financial services, the demands of online trading platforms and the needs of mobile payment apps have significantly increased, especially during the coronavirus outbreak. This has inevitably given rise to the e-commerce and FinTech market, which in turns provide more opportunities for virtual banking to grow as they are closely related to one another. The high traffic volume of online consumerism can be translated into the demands for more virtual banking services, namely the online payment solution that provides a more convenient alternative from the e-banking. As such, the rise of virtual banking can be seen alongside with the emergence of the e-commerce and FinTech market.

Young Demographic Pool

Besides that, the young demographic pool in the near future across the world is also the force behind the rise of virtual banking. According to a survey done by the Financial Times, millennials and post-millennials, commonly known as the Gen Y and Z, are the two most populous generations which currently amounts to 35% of the global workforce and will be flooding in the next 10 years. This has given rise to virtual banking as businesses started to adapt to these two tech-savvy and innovation-hungry generations. Though being widely acceptive of new products and services, both Gen Y and Z are also extremely selective in their choices of technology innovations. This has thus propelled the evolution of banking where virtual banking is on the top of their list, driving the rise of virtual banking beyond the global pandemic.

Regulatory Encouragement

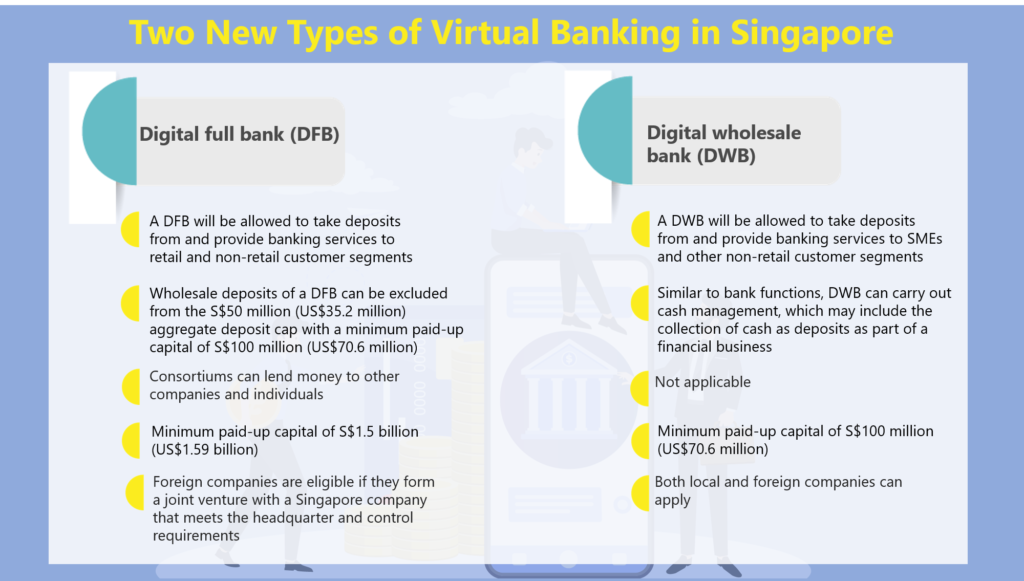

Lastly, the transition of regulatory attitude from the former passive to a more supportive role in enhancing the establishment of virtual banking has also encouraged the emergence of virtual banking, especially across the Asia-Pacific. Though there is still significant variability in the regulatory landscape for virtual banking in Asia- Pacific, the majorities are lowering the restrictions on virtual banking licensing, creating a more flexible and welcoming environment to virtual banking. Regions standing in the forefront of the FinTech market, like Singapore (Refer to Figure 1), Hong Kong (Refer to Figure 2), Taiwan and India, have since granted several virtual banking licensing as part of their efforts in liberalising their financial sectors, creating a more flexible and sustainable economic future. This has thus given rise to virtual banking as FinTech SMEs are jumping onto the opportunities to set up the online-only banking services before stricter regulations are imposed to prevent disruption to the banking sectors.

Why The Race into Virtual Banking?

In a recent study of virtual banking consumers’ satisfaction level, more than half of the consumers are showing 88% of satisfaction level during the use of digital-only banking as compared to the conventional banking experience. Here are some benefits that virtual banking provides that satisfied consumers as opposed to e-banking.

Enhanced Bank Services

By leveraging on digital platforms and cutting edge technologies, virtual banking offers an alternative banking services solution that focuses on creating a more affordable and convenient banking experience. According to the Global Banking Outlook, financial service consumers prefer virtual banking due to the personalised services, the convenience as well as the transparency on the operation.

With a touch of few buttons, account balances, banking information, money transactions, and even wealth management are available for one to access in real-time. This has made banking experiences much more efficient and easier as compared to conventional banking. Also, with the use of technology, there will be lesser manpower and infrastructure and overhead cost which allows virtual banks to provide higher interest rates on savings and lower loan interest on the mortgage. For instance, there is no paperwork to sign and this could save multiple headcount of counter staff to serve the customers.

In addition to providing an upgraded version of available banking services, virtual banking also can produce a diversified range of financial products and services across various sectors, enhancing the profitability of virtual banking in the long term. As such, virtual banking is believed to be a sustainable solution to the challenges that the banking sectors are facing, making it a promising investment hotspot.

Omni-digital approach

Moreover, the Omni-digital approach is another reason why virtual banking is attractive to both investors and consumers. The Omni-digital approach means the use of various consumption channels but only through a digital approach. Examples of virtual banks like Monzo and Starling are using such an approach by allowing their customers to access financial services and manage bank accounts through the sole help of various mobile apps.

This operational method has coincided with the consumer behaviour of potential customers within the financial sectors in the near future. According to a survey conducted by PwC on financial brands, younger generations are slowly turning towards the Omni-digital approach, with more than 46% of the population are internet and mobile dominant that prefers digital assistance rather than human interaction approach when it comes to financial services and products. As such, the prospect of virtual banking is blooming, making it a promising investment hotspot.

Yet, just like any other digital services, the concern of cybersecurity is a major dismissing factor that could potentially hinder the development of virtual banking. With this cyber threat constantly hovering over its development, virtual banks, like Monzo and Starling, have since enhanced their security means by installing exhaustive fraud prevention tools. One of the most common security methods is the 3D- Secure methodology, where one-time password and PIN code alongside biometric recognition is deployed to eliminate the threats of hackers and lowering the chances of cyber-attacks.

Invest in Virtual Banking Now

Undeniably, virtual banking is here to stay and grow. The evolution of the banking sector is inevitable due to the gradual digital inclined society, coupled with the global pandemic, virtual banking has proven its relevancy and competency in providing probable solutions that provide long-term benefits. As such, virtual banking, especially in the Asia-Pacific, is a promising investment hotspot for investors who are looking for a secure investing port during the current financial fallout.

However, investing in virtual banking can be a complex process with many underlying societal, economic and political risks and challenges, as such investors should be tapping on the expertise of financial advisors like Desfran. Spearheaded by one of the world’s leading management teams, we stay on top of trends and movements in various markets to help our partners pursue their options for business growth. Contact Desfran today to explore your business opportunities in virtual banking.

References

Why virtual banks are the future, Payspacelv.com

The Future Of Banking: Virtual Banks Chase the Dream in Asia-Pacific, Spglobal.com

The Rise of Virtual Banks in Asia is Posing New Cybersecurity, Fraud Risks: Jumio, Fintechnews.sg

Frequently-Asked Questions On Digital Full Bank (DFB) And Digital Wholesale Bank (DWB) Licences, Mas.gov.sg