Decentralised Finance (DeFi) refers to an ecosystem of financial applications that are built on top of the blockchain networks with the aim of thoroughly transforming finance with networks that are run by financial intermediaries.

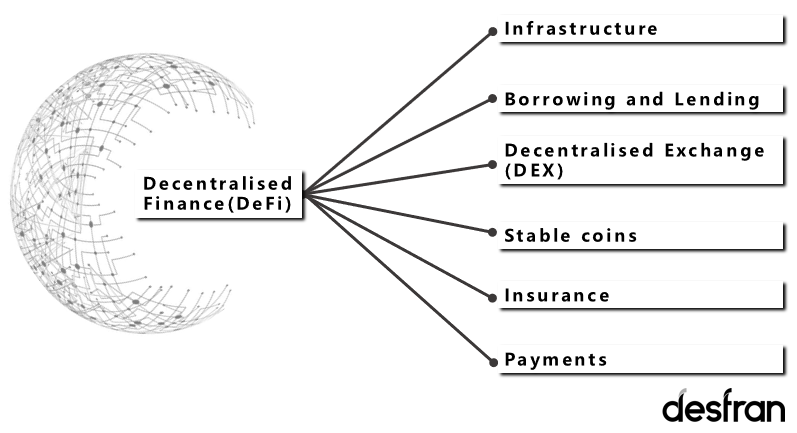

Cryptocurrencies like Ether, Bitcoin and many others could be traded peer-to-peer securely without intermediaries. Users have full control over their crypto assets. While the cryptocurrencies are decentralised, they still have not managed to decentralise the financial system and are typically accessed via centralised intermediaries. To move towards a decentralised financial system, many have started to gravitate towards the decentralised finance (DeFi) ecosystem, which includes a few categories, mainly stable coins, decentralised exchanges, wallets, payment networks, lending and insurance platforms, infrastructural development and marketplaces. DeFi essentially utilises the blockchain ecosystem to provide users with full control of their assets as well as financial services using conventional financial market structures. It adds transparency, stabilisation and efficiencies to global finance. Thus far, Ethereum platform is the primary choice in the DeFi ecosystem.

The DeFi ecosystem categories include: Infrastructure, borrowing and lending, payments, custodial services, insurance and the decentralised exchanges (DEX).

Stablecoins

Stablecoins are blockchain-issued tokens designed to hold on to a specific value, typically pegged to a fiat currency such as the US dollar. Stablecoins incorporate collateral to accommodate for any price variation. Stable coins collateralised with fiat currencies are generally redeemable at a 1:1 ratio. These stablecoins are built on trust in a centralised entity and are therefore exposed to the destabilization from external geopolitical factors. On the other hand, crypto-collateralised stablecoins are backed by crypto assets, they maintain their 1:1 ratio peg against assets through algorithmic methods. Non-collateralized stablecoins use an algorithm whereby the system supplies more tokens with increased demand while the price of each token is lowered and vice versa to maintain a stable peg. Dai, from MakerDAO.com, is the most in demand crypto-collateralised stable coin thus far due to its openness, stability, and censorship resistance.

Decentralised Exchanges

Most exchanges are built on the Ethereum blockchain. Some examples of decentralised exchanges (DEX) would be Radar Relay, Binance DEX and EtherDelta. As these exchanges are still in early stages of recognition, the volume is still not substantial.

Borrowing and Lending

Albeit the concept of a loan is simple to comprehend, lending is a relatively new concept in the world of cryptography, enabling individuals to obtain capital or earn interest on their digital asset holdings.

DeFi lending protocols pay interest on cryptocurrency deposits from the margin generated through loan issuance, with smart contracts automating the process through a decentralised network rather than an intermediary. These protocols are generally Ethereum-based. Although some familiarity with crypto is an advantage, these decentralised protocols are committed to lowering the barriers to entry and enticing more market penetration. In principle, investors tend to earn significantly higher returns from crypto lending.

For now, DeFi lending protocols generate over $650 million in annual interest; borrowers, meanwhile, have taken out almost $7.5 billion in loans. While these numbers are minuscule when compared to the regular credit market, they are growing all the time. And as the price of assets like Bitcoin and Ethereum rise, more people are likely to put their savings to good use by locking them up to earn yield.

Infrastructure

The extent of decentralisation in DeFi services varies as not every component in the ecosystem is decentralised. For instance, we can have a framework for decentralised lending such as price feeds, protocol development, interest rate determination and custody.

Not all stablecoins are decentralised. These are simply tokens that assume the role of fiat currency deposits held in a certain bank. Prior to the regulatory bodies and legislators accepting and adapting to DeFi services, some form of centralisation will still be in place. To give an example, if you wish to buy a property on the blockchain, despite having the deed and law tokenised, the courts of that particular jurisdiction will still have to advance to legally recognise the tokenised deed.

Of course, the DeFi market is a lot smaller compared to the traditional finance market, however, it has picked up its pace since 2020. The total value locked in under DeFi protocols have skyrocketed to over $2 billion. DEX’s made a record and continue to gain market share on centralised exchanges. As the trend progresses with more interesting projects, we can expect the traditional finance market to be interoperating with blockchain and such digital assets in sync.

To put it briefly, DeFi’s key advantages are:

- Accessibility

DeFi will grant for worldwide participation. Anyone who has an internet connection will be able to access it. In some countries where the banking system is still underdeveloped or tightly controlled, DeFi will be able to assist with banking-like services via a smart phone.

- Ownership

It runs on the blockchain, everyone will have full control over their assets, there is no central authority who can revoke your account or halt your transactions.

- Transparency

Despite open banking (click here to read about open banking), DeFi has all its functions naturally built in. Every transaction is publicly visible on the blockchain, verified by other blockchain users.

How can DeFi help your business? Talk to us to find out how we can efficiently help your business stay ahead of the competition.